The use of a lifecycle cost analysis is a recommended method to procure wastewater equipment. In any large purchase the buyer should consider looking at the entire cost of ownership. Lifecycle cost captures the labor and replacement value over the timeframe of the equipment service life. A common example of this today is the purchase of an electric vehicle versus a vehicle with internal combustion engine.

Lifecycle cost is valuable for procurement of wastewater treatment equipment such as septage receiving stations. The lifecycle cost of a septage receiving station is evaluated typically over a 10 or 20 year period. Lifecycle cost analysis for a septage receiving unit can include the following parts:

Lifecycle Cost = {Capital $ + Operations $ (Over Service Life) + Maintenance (Over Service Life)} X UPW

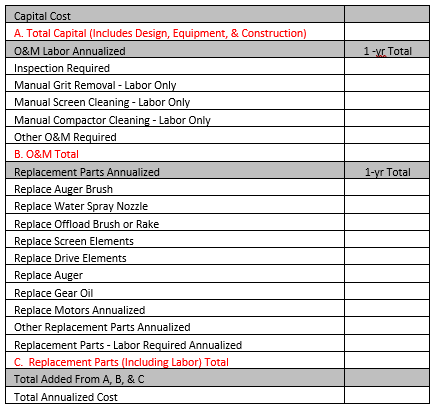

A general lifecycle analysis could also include the cost of utilities (such as power and water supply costs) transportation costs, land use costs etc. These factors are not significant for the septage receiving system presented. Table 1 on the right provides a cost breakdown for a typical analysis for wastewater treatment process equipment such as a septage receiving unit.

For this analysis a 20 year lifecycle is common. The lifecycle cost is total of all costs over the service life of 20 years (the time value of money is not considered in equation 1 for simplicity).

(1) Lifecycle cost = Total Annualized Cost X (20)

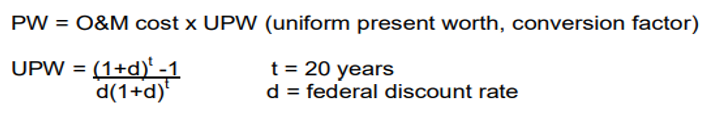

The time value of money can be taken into account in this analysis. Future dollars are worth less than present dollars. Many evaluators use a factor called the Uniform Present Worth factor (UPW) to capture the time value of money. Equation 2 presents the lifecycle cost considering UPW. UPW shall be defined in the next paragraph.

(2) Lifecycle Cost = Total Annualized Cost X UPW

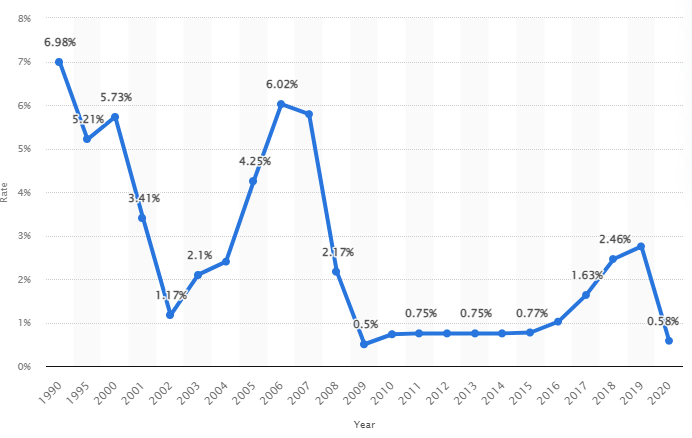

The federal discount rate as stated below is defined as the current rate of interest that banks can borrow money from the federal reserve. This is a general measure of the rate of inflation of the economy. An amount of $1 in 2000 is worth $0.82 in 2020 as a broad measure based on average discount rate over time.

The reason that UPW is less than 20 is that current money is worth more than it’s projected future value. The federal discount rate is currently averaging 2.21% over the last 20 years (See Source Table Below)

UPW {t=20, d=.0221} = 16.0

Source – Statista.com/Federal Reserve Bank of NY Discount Rate

4750 118th Avenue North Clearwater, Florida 33762 USA Phone: +1 (813) 818-0777 Fax: (813) 818-0770

Copyright ©2025 Hydro-Dyne Engineering. All Rights Reserved. | Privacy Policy | Terms of Use